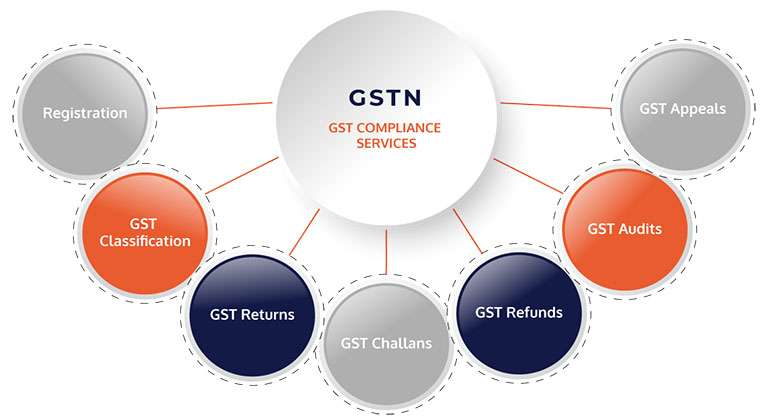

GST Compliance Services

The goods and service tax (GST) came into force in india from july 1, 2017.

It replaced multiple indirect taxes and put everything under one umbrella. KMS has a team of expert GST consultants who can provide you GST compliance services. We can help you navigate through the complex maze of GST and achieve compliance with all the requirements. Since with the introduction of GST, it has become necessary for businesses to be correct and true granularly in tax reporting, our GST Consultants’ keen attention to detail will make it possible for you. Moreover, since companies have an added responsibility of ensuring that the other third parties involved in the supply chain are also GST compliant, we, at KMS, bring that coordination and communication between the businesses to ensure GST compliance by all. We also keep ourselves updated with all the new amendments in the laws, procedures, and guidelines related to GST compliance so that our clients are not left behind in meeting the requirements of GST regulations.

Taxation

GST Refund Services

There are multiple compliance requirements and statutory obligations that taxpayers have to follow within deadlines under the GST regulations for efficient business processes.

our services inregards to GST refund include the following

- Understanding of the transactions for claiming gst refund

- Matching and uploading of invoices

- Support in filing the application for the GST refund claim

- GST refund calculations